Payoneer is one of the payment platforms I use the most when it comes to getting paid by clients.

Is not your only choice if you are looking to receive payments from clients all around the world, of course.

But some of its features make it unique. Like the possibility of accessing a Mastercard debit card regardless of where you come from.

In this guide you will learn:

- What is Payoneer?

- How to open a Payoneer account

- How to get the Payoneer Card

- How to get paid with Payoneer

- How to withdraw money from Payoneer

- How to buy cryptocurrencies with Payoneer

- How much does Payoneer cost?

- Should you use Payoneer?

What is Payoneer?

Payoneer is a payment solution for businesses, entrepreneurs, and freelancers who work globally. It allows you to receive payments from almost every country.

Currently, you can receive payments in USD, EUR, GBP, CAD, AUD, JPY, and CNH. If your client makes a payment in another currency, Payoneer will exchange it.

How does Payoneer work?

Besides receiving money and transferring it to your bank account, you can make payments in physical and online stores, make withdrawals at ATMs, pay for services, and more.

What can you do:

- Receive bank transfers from companies.

- Receive credit card payments from individuals and companies.

- Pay suppliers directly from your account.

- Transfer your balance to your bank account.

- Use the prepaid card to make payments and withdraw money from ATMs.

- Use the virtual card for online payments and transactions.

- Exchange money between accepted currencies without leaving the platform.

- Buy cryptocurrencies.

What you can’t do:

- Receive payments via bank transfer from individuals.

- Transfer money to a private bank account that is not your own (except for payment to suppliers).

- Add payment buttons on your website.

- Make automatic recurring charges.

- Make transactions related to games of chance.

- Use your account for P2P (Peer to Peer) transactions.

How to open a Payoneer account

Signing up for a Payoneer account is a quick and easy process.

To do so, you must meet the following requirements:

- Be +18 years old

- Have your own bank account

- Identity proof (invoices in your name, bank statement, etc.)

- The obvious: email, phone, address.

Steps to open a Payoneer account

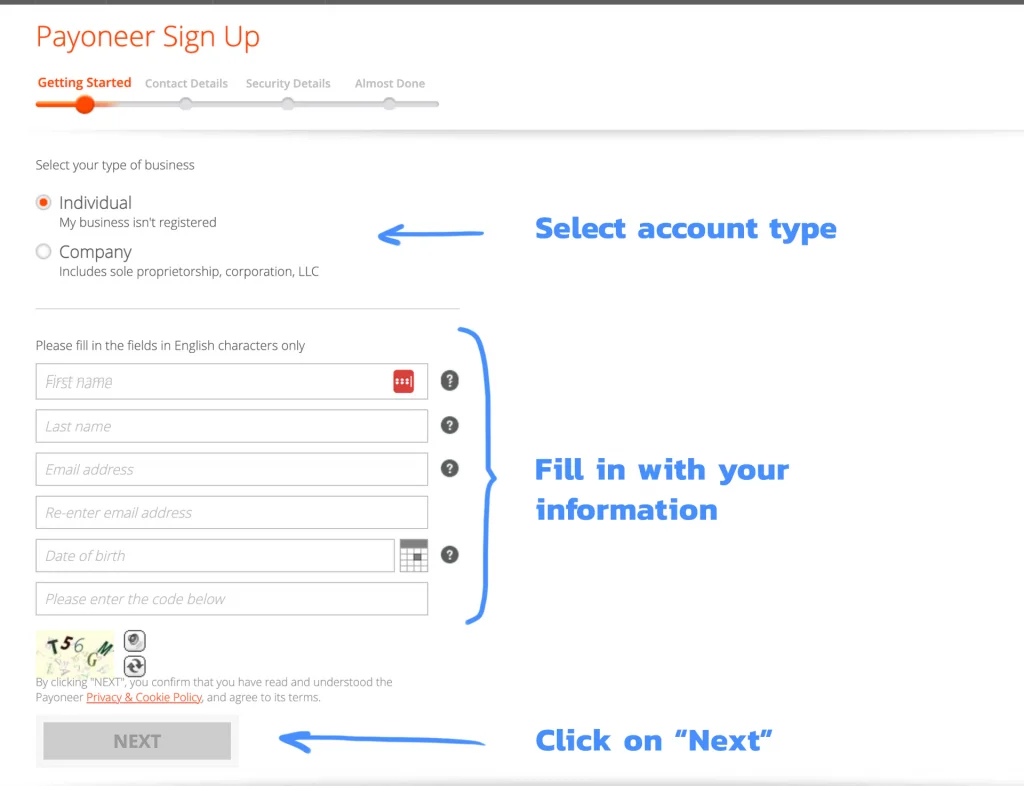

1. First Steps

Go to the Payoneer website (by clicking on this link, you will receive $25 as a gift*.)

If you are a freelancer or individual, select “Personal Account (Individual)”. If you are a registered company, choose “Business Account (Company)”.

Complete with your personal information: name, surname, email, and date of birth.

Don’t forget to write your name exactly as it appears on your personal identification (identity document, passport, etc.).

Once all the data is complete, click on “Next”.

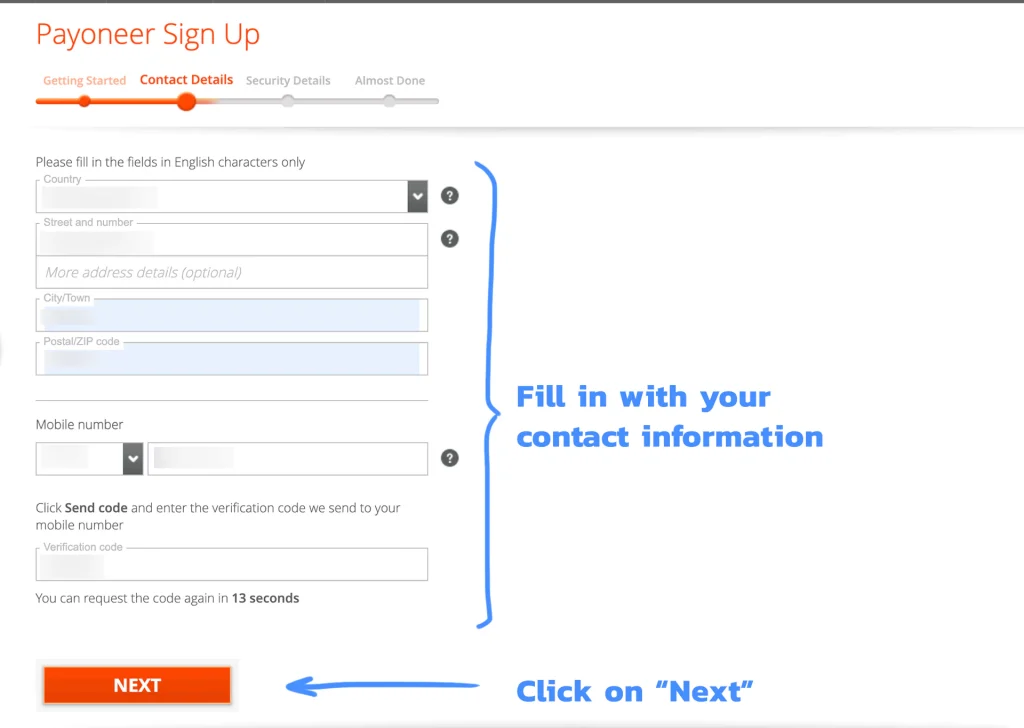

2. Contact information

Now, fill in the fields with your contact information:

- Country

- Address

- Town

- Postal Code

- Cell phone number

Like in the previous screen, use the same information as it appears in your personal identification.

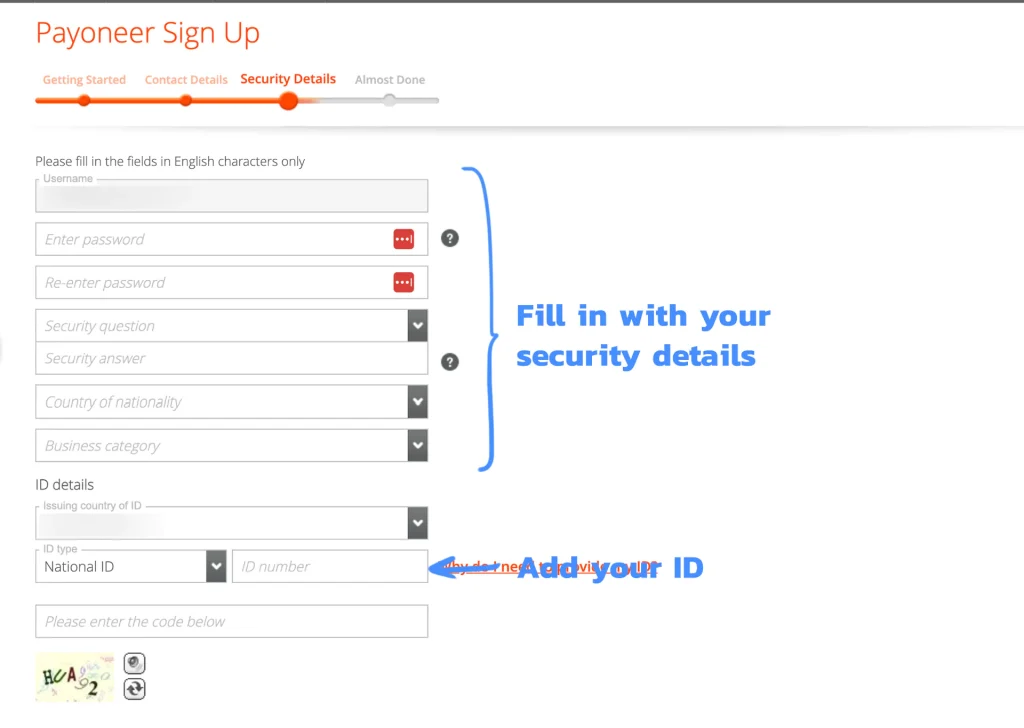

3. Security Data

Security data! Always important. Complete the fields with:

- Username

- Password

- Security Question and Answer

- The country issuing your ID

- Type and identification number

Do not forget to copy the code in the corresponding field before clicking “Next”.

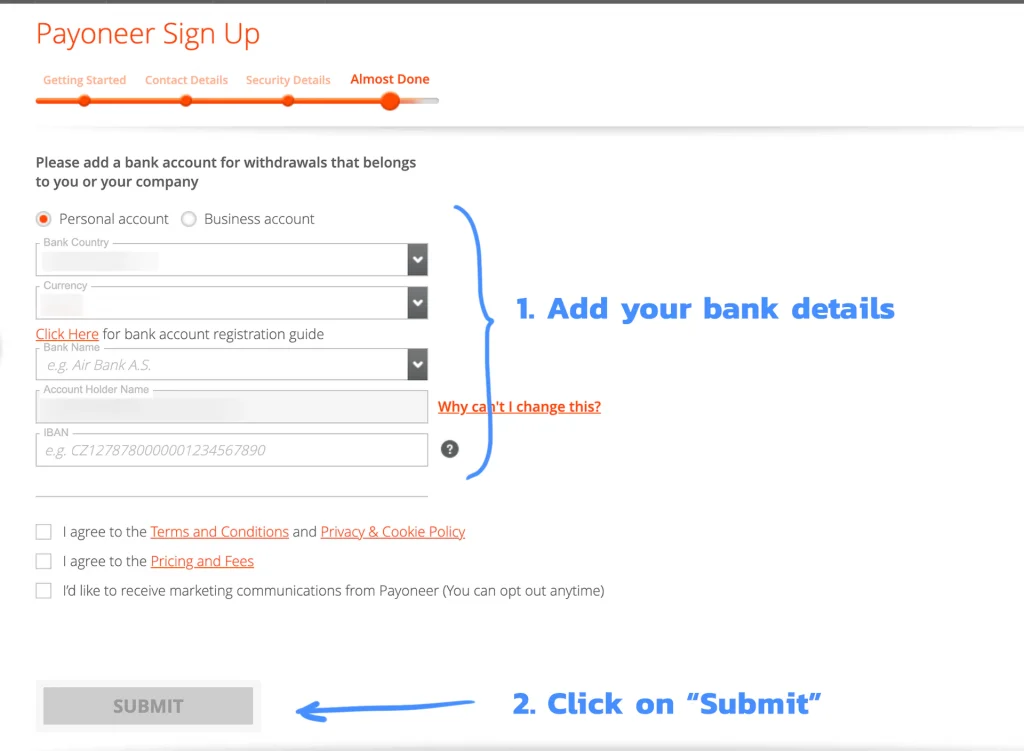

4. Almost done

As the last step, add your bank account information to receive payments from Payoneer. Accept the terms and conditions before clicking “Send”.

Having a bank account is not optional. Even if you do not intend to withdraw money from your Payoneer to your bank, you still need it to create an account.

You must be the account holder. You can’t use other people’s accounts.

Later, if needed, you can link up to 3 bank accounts to your same Payoneer account. It’s very useful if you have bank accounts in different currencies.

At this point, Payoneer will review your information before approving your account. You will receive a confirmation email once activated.

You will be asked to confirm your identity by uploading a photo of your ID, submitting bills in your name, or providing bank statements. The important thing is that the address you declared matches the one in the documents.

You can receive payments from Payoneer partners and companies once your account is approved. However, there is a payment threshold for individuals, meaning you have to get paid from companies or Payoneer partners first to unlock this option.

How to get the Payoneer Card

The Payoneer card is essential if you want to use your account balance.

You will have access to the virtual card as soon as you sign up. With it, you can pay for most things online.

However, to fully use Payoneer in your everyday life, you will need a physical card. Once you order your Payoneer Mastercard debit card, you will be able to withdraw money from ATMs, pay in stores, use it online, and more.

Payoneer Mastercard Card Requierments

To request the card you need to receive at least USD100 in payments to your account. Transfers between Payoneer accounts and payments from electronic wallets such as Paypal or Skrill DO NOT count.

In other words, that money has to come from payments from one of Payoneer’s partners, or some other registered company.

If you qualify for the card, you will find the option to request it as I explain in this mini tutorial:

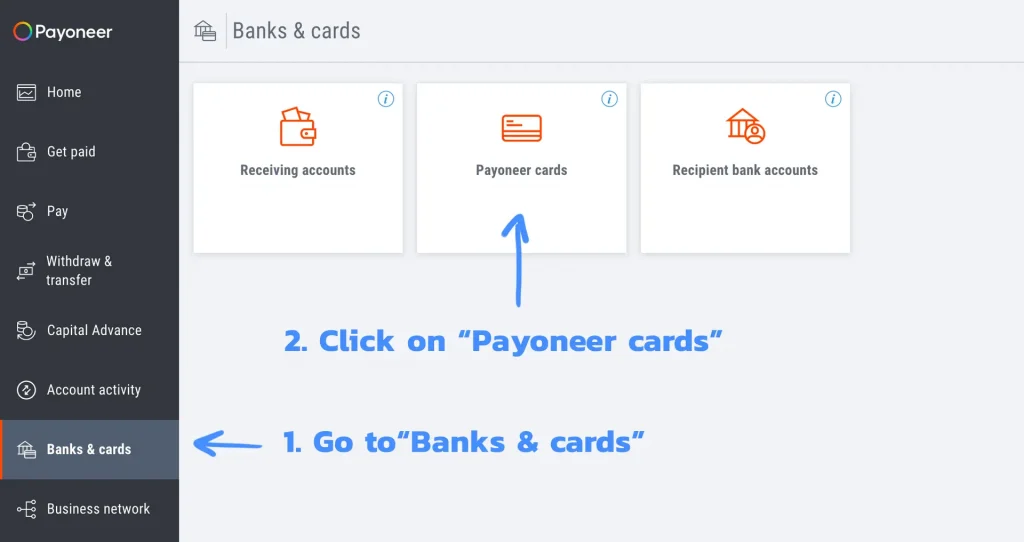

1. Log in to your Payoneer account and in the “Banks & cards” menu, click on “Payoneer Cards”.

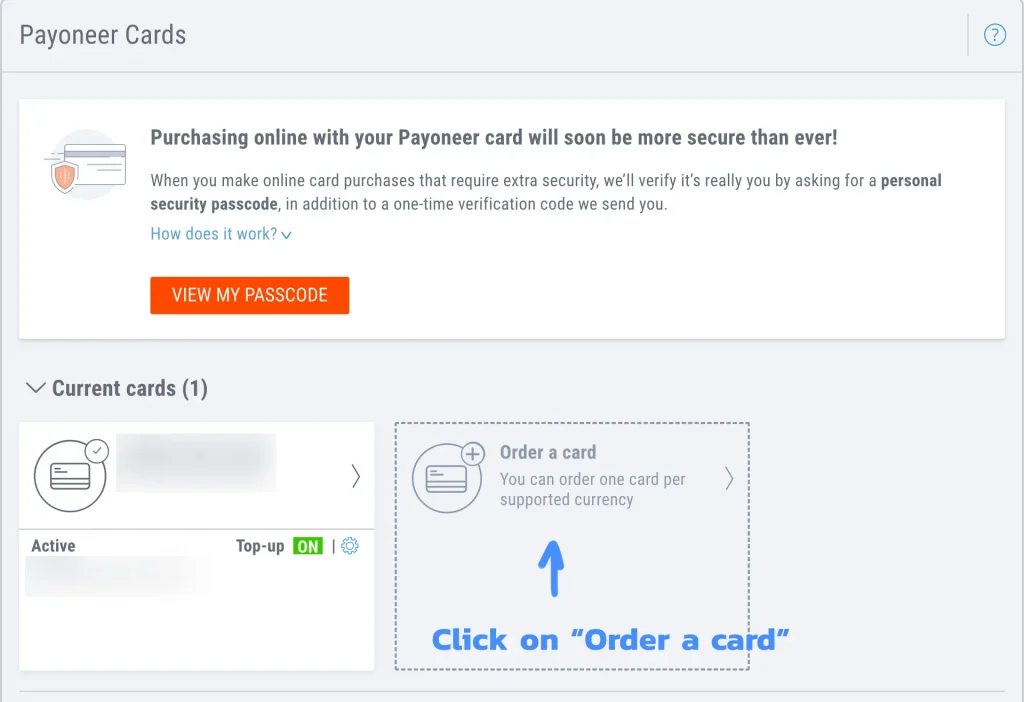

2. In this section you will be able to access all your cards, current and expired. To order a new card, click on “Order a card”. Remember that you can request a card per currency.

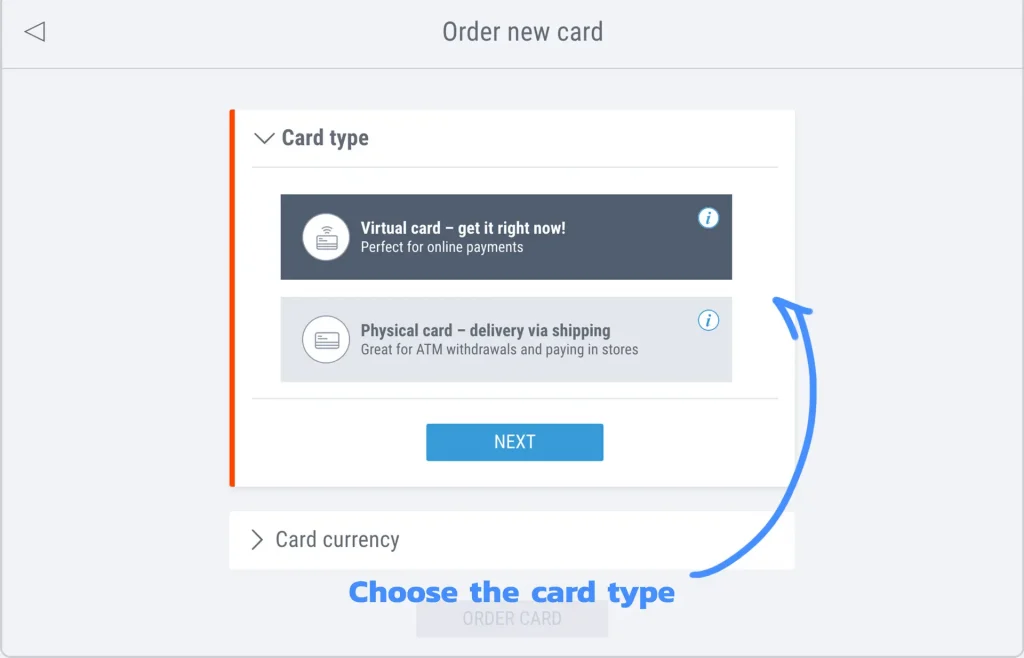

3. Choose the type of card you want. In this case, the physical card.

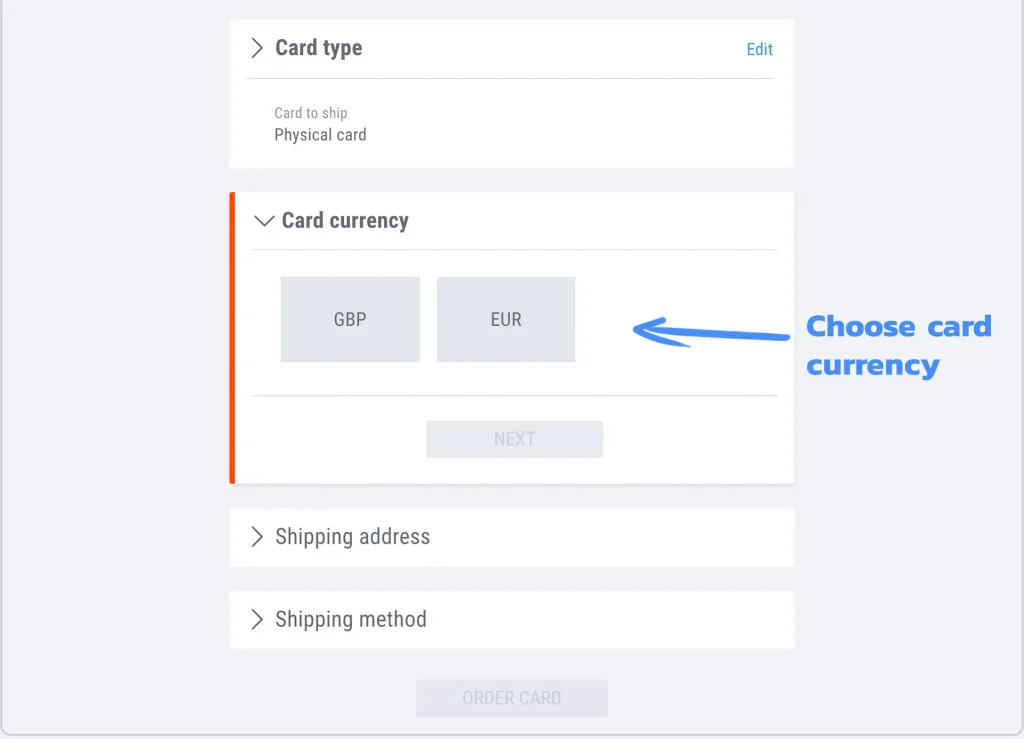

4. Choose the currency of your card. You will be able to select them from the active currencies in your account.

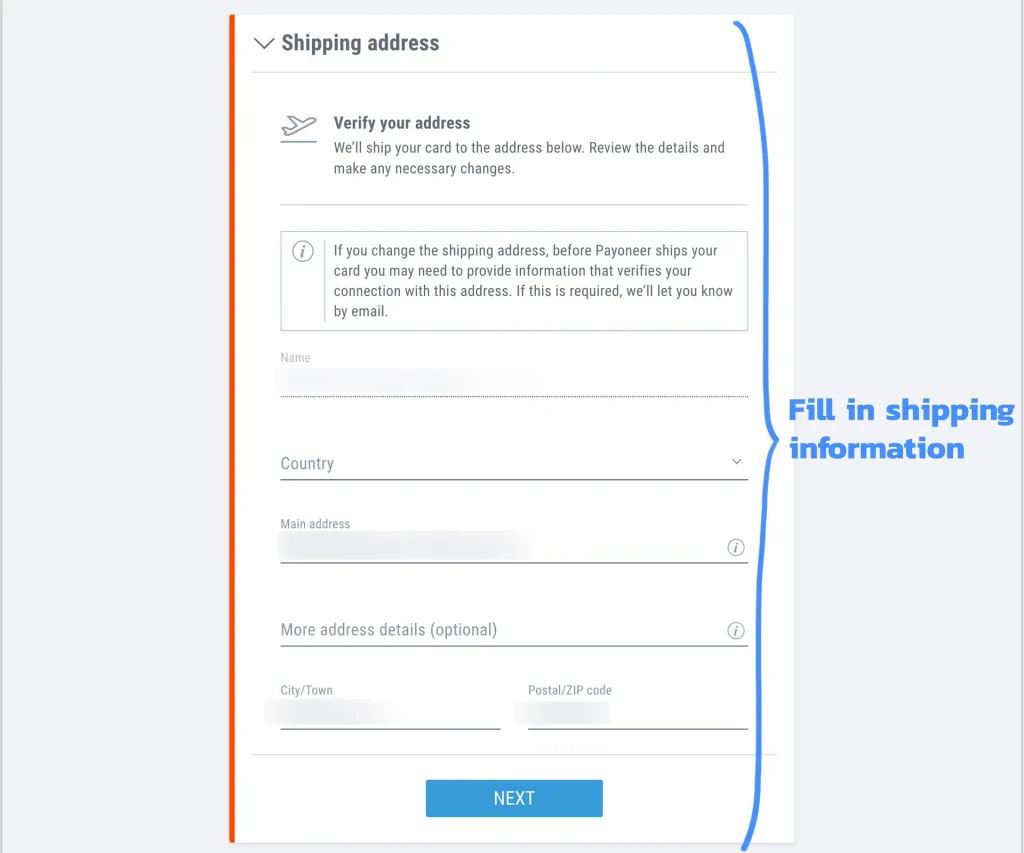

5. Fill in the shipping information. Remember that you will receive the card at the address set in your account. If you want them to send it to a different place, you will be asked for information that verifies your connection to that address.

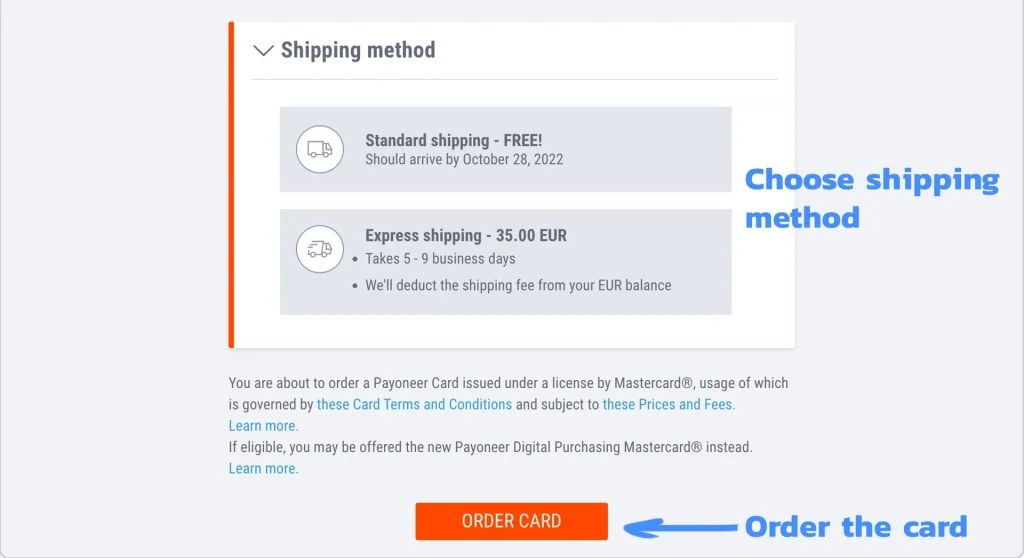

6. Finally, select a shipping method and click on “Order card”. Be sure to read the small print!

When your card arrives, follow the activation instructions, and voila! Keep in mind that the card will be sent to the address you registered with.

How much does the Payoneer card cost?

When ordering the card for the first time, US$30 will be deducted from your balance (€24.95 for a card in euros or £24.95 if it is in pounds sterling). The annual maintenance has the same value.

But unfortunately, that is not the only cost. Depending on how you use it, you will have to pay different commissions:

- Card replacement in case of loss or theft: US$30 / €24.95 / £24.95

- Purchases online or in stores: Free. But there might be a commission in case of cross-border payment of up to 3.5%

- ATM or bank withdrawal: U$D3.15 / €2.50 / £1.95 per transaction.

- ATM refusal or balance inquiry fee: U$D1 / €0.80 / £0.65 per transaction.

If there is no money in your account for the annual maintenance, it will be automatically deducted from the next payment you receive.

Be careful if you want to use ATMs! Besides the Payoneer fee, each bank also adds its own. In other words, getting cash in this way can end up being very expensive.

My advice: avoid them unless it’s an emergency.

You can read about all the related costs to operating with your Payoneer account here.

Is there more than one Payoneer card?

You can request a card for each active currency in your Payoneer account. If you work with euros, dollars, and pounds, you can request the 3 corresponding cards.

Is it worth having so many cards? It depends. If you receive many payments in different currencies and want to use the card at physical points of sale, then yes.

But remember that there is also the option of using digital cards, which are free of charge.

If you lose the card (due to theft, breakage, or simple loss), you can request a replacement. However, you will have to pay U$D30 again.

It is important to note that the card is always sent to your official address. In the event that you want to receive it in another place, you must present documentation that confirms your residence at this new address.

This means that if you are traveling and your card is stolen, the replacement will arrive at your official address.

How long does it take for the card to arrive?

Delivery times depend on each country and its postal system. When they send you the card, they give you a tracking number so you can keep up to date on where the magic plastic is.

How to use the Payoneer card

You can use the Payoneer card like any regular debit card, as long as Mastercard is accepted as a payment option.

In other words, you can pay for things online, make purchases in physical stores, and withdraw money from ATMs.

How to load balance on Payoneer card

You can choose to top up your card with your account balance automatically, or not.

To do this, go to the “Payoneer Cards” section within “Settings”. There, you will be able to change the loading setting of each card and also choose a maximum balance amount.

Keep in mind that the largest balance allowed is US$10,000.

Is not possible to “load credit” from your bank account or credit card as if it were a pre-paid phone.

Buy and pay with the Payoneer card

You can use the card to buy goods and services both online and in stores.

For physical stores or to withdraw money from ATMs), you will need a PIN assigned when activating the card. If you don’t remember it, you can reset it within your Payoneer account.

For online purchases, Payoneer also requires a personal code you can find in the Cards section, plus a unique code sent to your phone.

Cash withdrawal by ATM, bank, or store

If you want cash, the fastest option is through an ATM withdrawal.

Important! ATMs will give you the money in local currency at the official exchange rate of the day. So if you are in Argentina or Thailand, you will not be able to withdraw dollars or euros.

Warning: using the Payoneer card for ATMs is expensive. You have to pay for Payoneer’s fees plus the ATM’s fees. You will be able to check the total before going through with the operation.

If you have an emergency and need to get cash fast, using the card for withdrawals is an option. Otherwise, avoid it.

My own experience: We use the Payoneer card a lot when we travel. It has saved us more than once when traditional credit cards didn’t work for some reason.

On the other hand, we had a problem with one of the cards which we had to cancel while in Turkey, and the replacement was sent to Argentina.

In order to request the card to be sent to a different address than the one you have registered in your account, you will have to present proof of residence (accounts in your name, rent, etc.).

How to get paid with Payoneer

One of the biggest great advantages of using Payoneer is that you can receive payments from almost anywhere in the world via credit card or bank transfer.

Learn how to charge international customers with Payoneer by following this guide.

The steps to receive customer payments to your Payoneer account are pretty simple.

You will have to choose between the different payment options depending on your client:

- Global Payment Service

- Request a Payment

- Receive money from Associates (mass payment companies)

- From another Payoneer account.

Keep in mind that, unlike Paypal, Payoneer is intended for business transactions only. You cannot receive donations, gifts, or make balance top-ups.

I’ll explain what each option consists of and when you have to use them.

If your client is a Company:

Global Payment Service

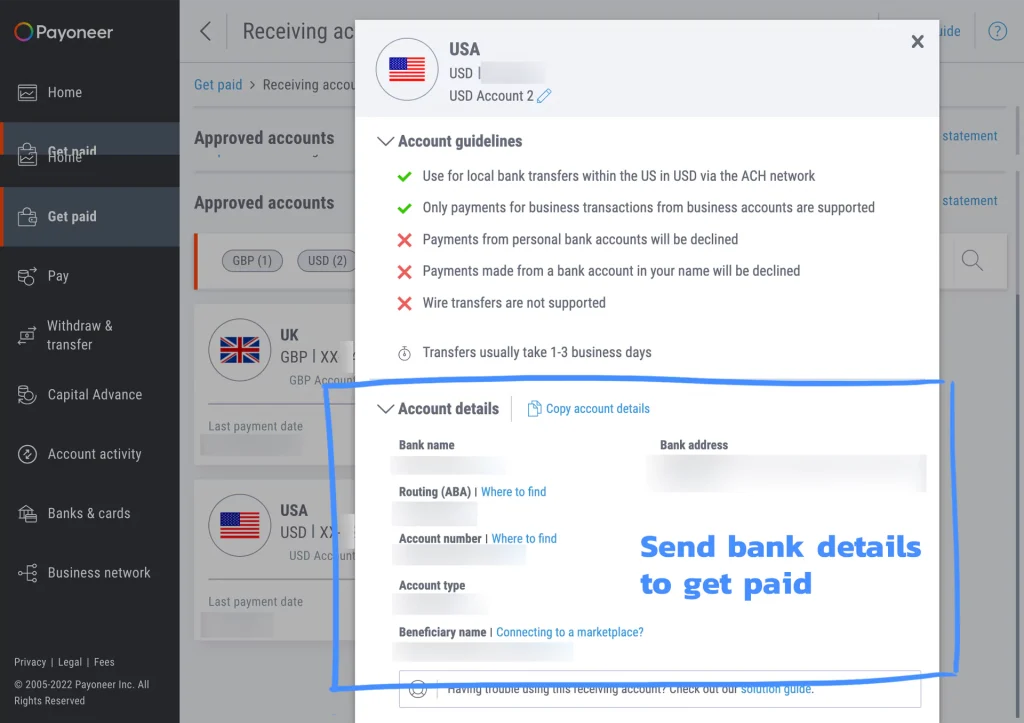

If your client is a company, they can pay you via local bank transfer in USD, CAD, AUD, EUR, GBP, SGD, JPY, and HKD. It works like this:

- Payoneer gives you the bank details of a receiving account for each currency.

- You send these bank details to the company.

- The company makes a direct bank transfer.

- The money arrives directly in your Payoneer account.

You also have an international Swift account to receive payments from any country.

All this process is done from your account.

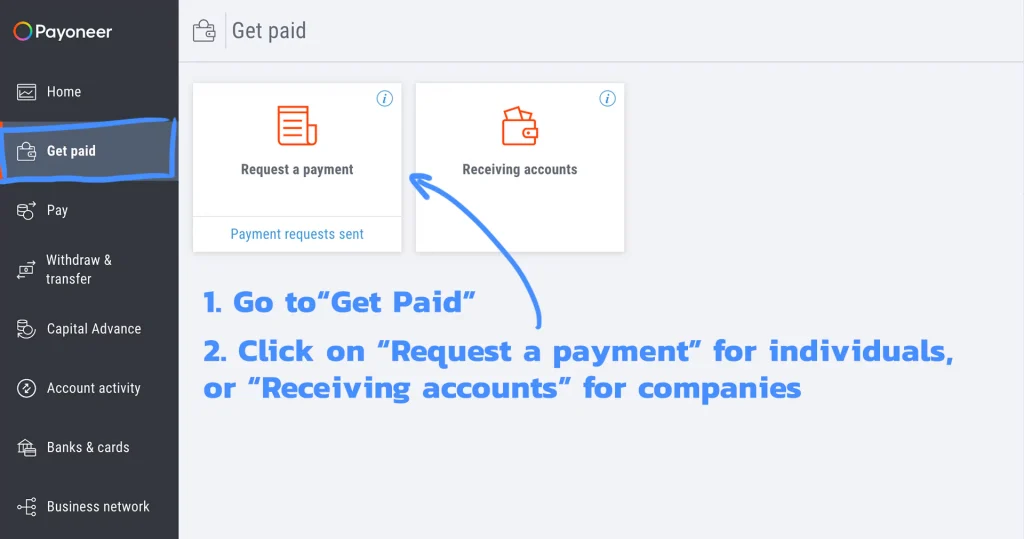

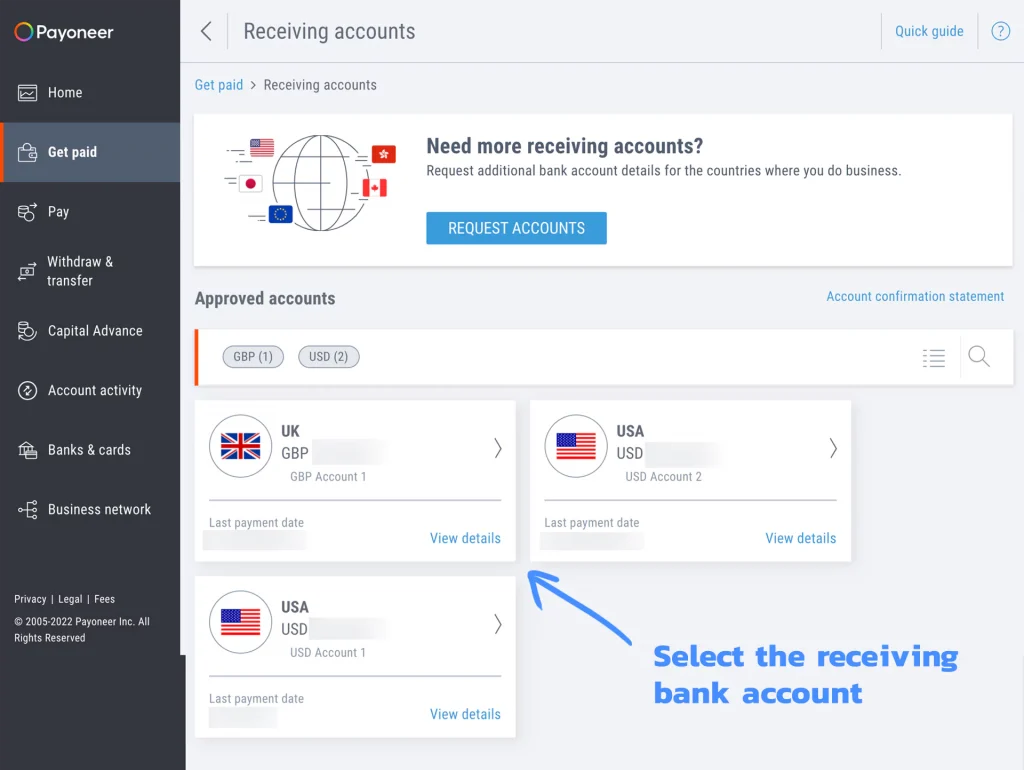

1. In the menu, within the “Get paid” section, you will find the link to “Receiving accounts”

2. In it, you will see the bank accounts of the different active currencies in your Payoneer.

You can request new receiving accounts for free.

3. By clicking on a bank account, you will access all the details the client company needs to make a traditional bank transfer.

Simply copy the data and send it to the company.

And now you wait for the payment to arrive.

If you want to know more about this service, click here.

Mass payment companies (Associates)

The Associates are the so-called “Payoneer Partners”. These are companies partnered with Payoneer to use the service as a payment option. For example, freelance platforms like Upwork and Fiverr, rental sites like Airbnb, and more.

Unlike the other payment methods, you have to define Payoneer as your payment gateway from within the platform you are working with.

If you don’t have a Payoneer account, you will be given the option to create one. Or you can click here and receive a $25 gift (once you receive $1,000 in payments).

Once you link the accounts, you will be able to withdraw the money directly to your Payoneer account.

If your client is an individual:

Request a Payment

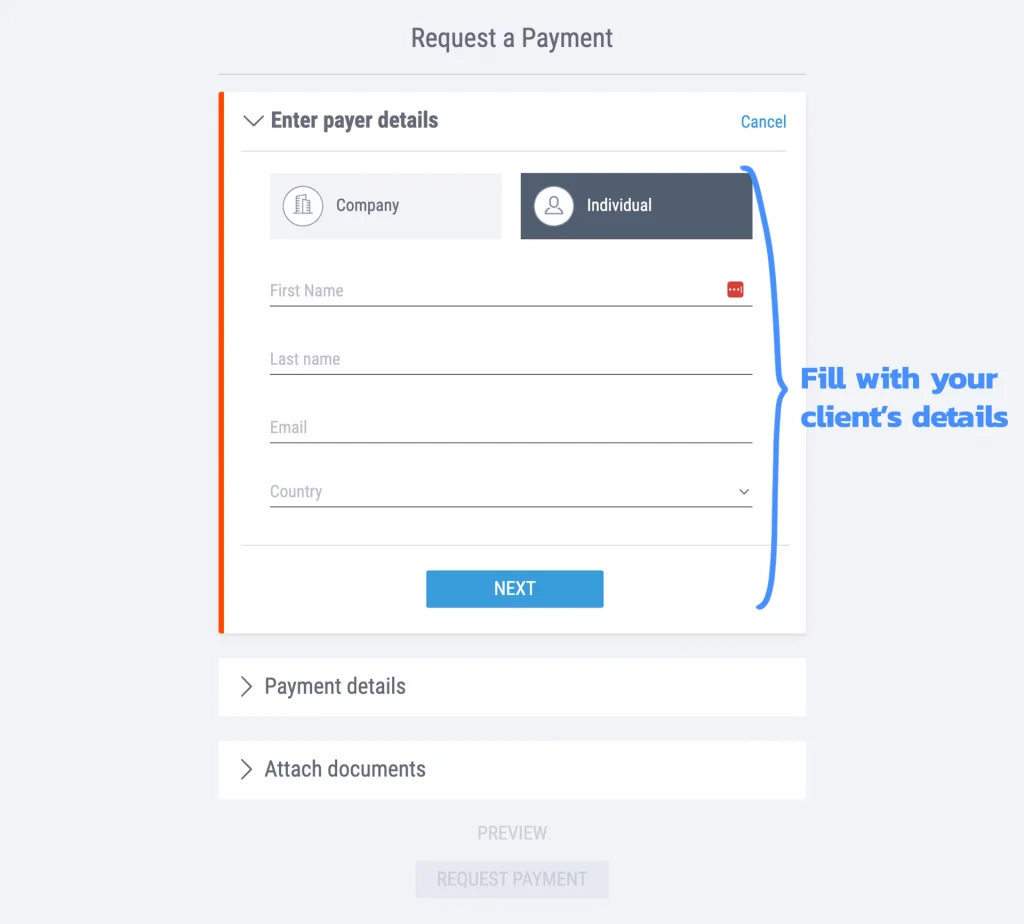

If your client is an individual and not a company, you need to choose the Request a Payment option to get paid.

Instead of sending them bank details to make a regular transfer, you will send them a payment link. They can pay you by credit card.

- You create a payment request from your account.

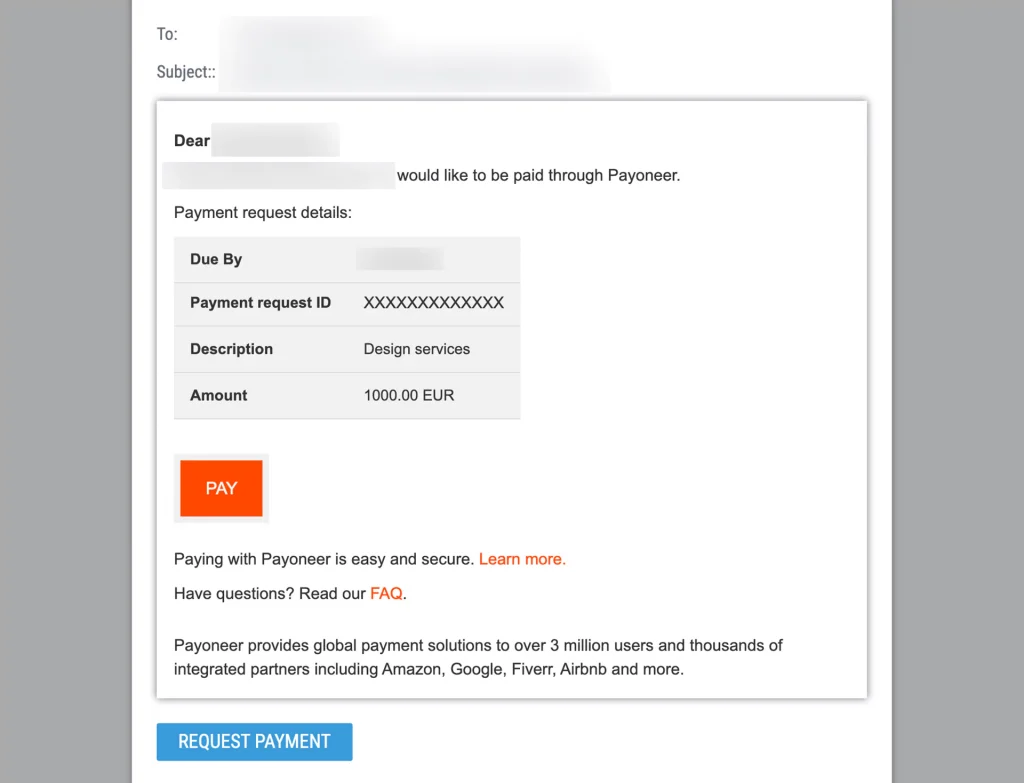

- The customer receives an email with the payment link.

- Pay by electronic or bank means.

- The payment arrives directly at your Payoneer account.

From your Payoneer account, follow the steps below to request a payment from a customer:

1. Within the “Get paid” option in the menu, you will find “Request a payment”.

2. Choose to who you are going to send the payment link. If you have received payments from that person before, you will find it saved as a contact. If not, click on “Add new”.

3. Select “Individual”, and complete with:

- Name

- Surname

- Country

You can choose this option to request payments from companies as well, without having to send them bank details manually.

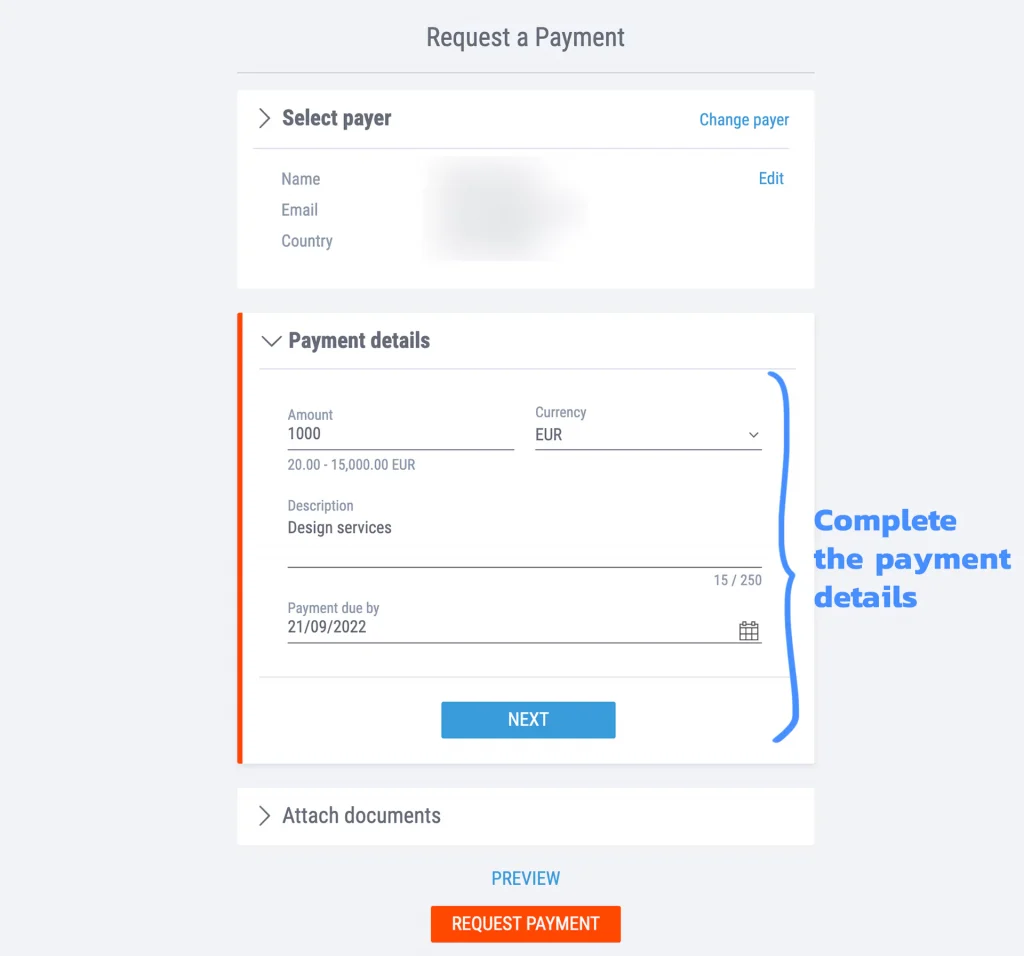

4. Fill in the required payment details:

- Amount and currency

- Description

- Payment due

5. Check all the data -especially the amount- before confirming the request. Once you click “Request Payment”, your client will receive an email with the payment link.

Transfers between Payoneer accounts

This is very useful when both parties have a Payoneer account.

Transferring funds from one account to another is as simple as clicking on “Make a Payment” and adding the recipient’s email.

But beware! This service is not available to everyone. You have to receive payments using one of the other options first if you want to send and receive money from another Payoneer account.

To make a payment to another Payoneer account, follow these steps:

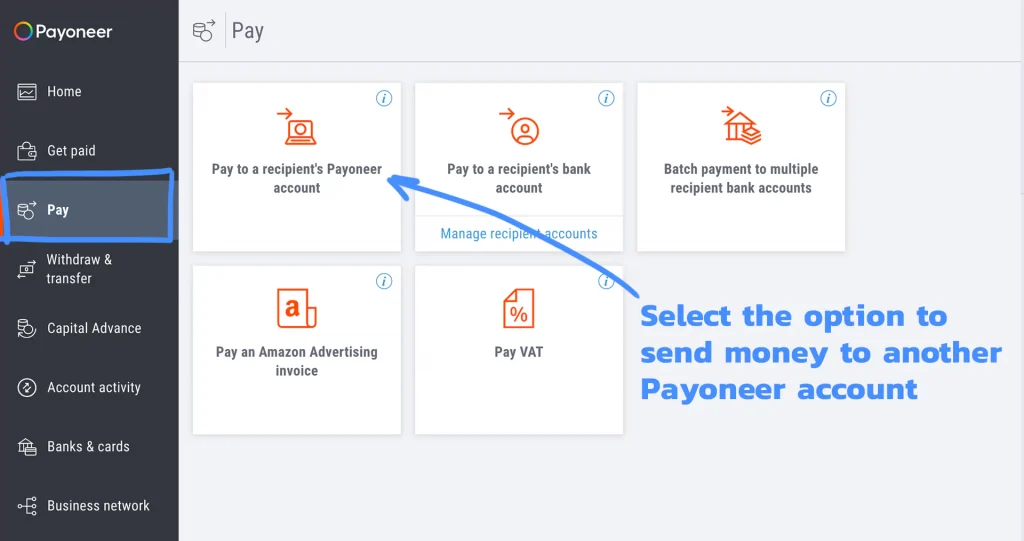

1. If this option is unlocked, you will find the option to “Pay to a recipient’s Payoneer account” within the “Pay” menu.

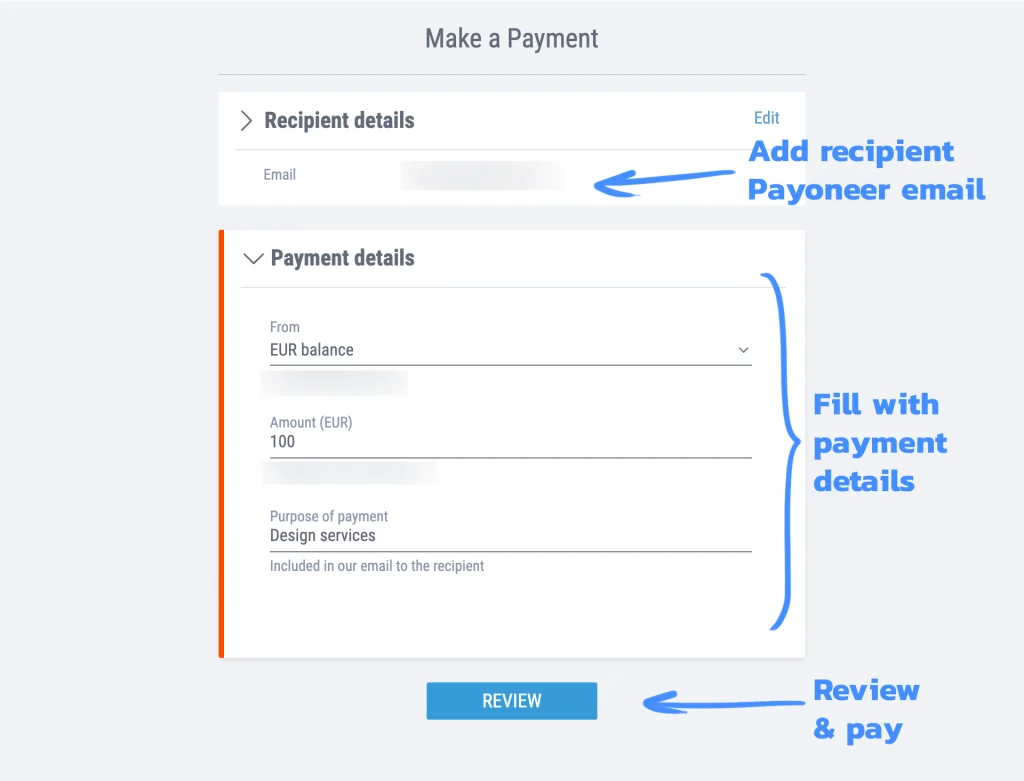

3. Enter the email of the Payoneer account you want to make a payment to.

4. Select the balance you want to pay from.

5. Followed by the amount.

6. And the concept.

7. Finally, review everything before sending the payment.

8. Confirm, and that’s it!

If you want to receive a payment from another Payoneer account, share your email address so that they can follow these same steps.

Now that you know how to charge with Payoneer, it’s time to learn how to withdraw money from your account.

How to withdraw money from Payoneer

Do you want to know how to withdraw money from Payoneer? There are two options: using the Payoneer card, or through a bank transfer.

How to use your balance with the Payoneer Card

Using the Payoneer card is the easiest and cheapest way to enjoy your hard-earned dollars (or euros. Or pounds. Or any currency accepted by Payoneer).

With the card, you can:

Pay for products and services online

Do you want to subscribe to Skillshare? Buy something on Appsumo? Pay for an apartment on Airbnb? Make a purchase on Amazon or BookDepository? Pay for your hosting or any other type of recurring service?

All this -and more- can be done by using the Payoneer card as an ordinary card.

For online payments, you will need to verify your purchase by using a code you can find in the “Payoneer Cards” section. You will also receive a verification code on your cell phone.

Buy products and services in physical stores

As long as they accept Mastercard as a payment option, you will be able to use the card as if it were a regular card.

Keep in mind that although the Payoneer card is a debit card, the posnets treat it as if it were a credit card.

Why? No idea. But that’s the way it works.

You cannot pay in installments, even if they offer it to you at the store.

When paying some stores will ask you for the PIN. This PIN is assigned when the card is activated, and you can change it from your account settings.

ATM withdrawal

If you want to use bills instead of paying with a card, you can go to an ATM and make a regular withdrawal.

But beware! It is the most expensive option.

You will pay commissions from both Payoneer and the bank itself as if it were a foreign bank account. Keep in mind that ATMs have different withdrawal limits as well. You might need to make several operations depending on how much money you want.

You will pay:

- Payoneer commission: $3.15

- Bank commission: USD10 (or whatever the ATM charges. It tells you at the time of withdrawal)

- Currency exchange fee

My own experience: in banks in Argentina I found withdrawal limits of ARS5000, and I had to pay US$13 in commissions.

At ATMs in Uruguay, the limit was US$300, and I paid US$20 in commissions.

In Germany, I was able to withdraw up to €2000, and pay $20 in commissions.

As you can see, there is no fixed rule to knowing how much you are going to pay per extraction. What is certain is that it is the most expensive option. I recommend that you use it only in case of emergencies.

Withdrawal by bank transfer

The other option to access your money is to transfer your Payoneer balance to your own bank account.

You can link up to 3 bank accounts in different currencies, as long as they are in your name.

Keep in mind that if your balance and your bank account are in different currencies, you will have to pay a small commission for the exchange.

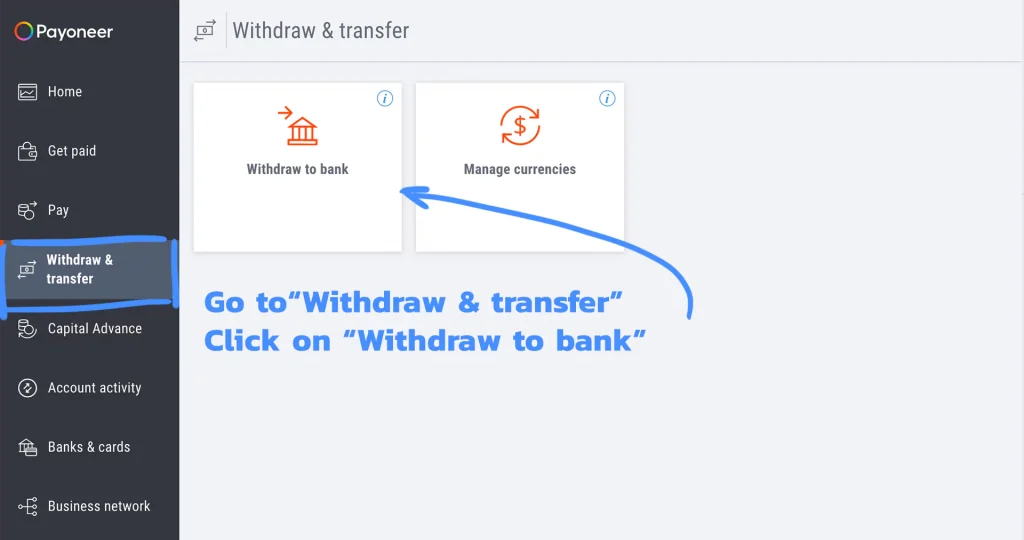

To transfer to your bank account from Payoneer, you have to follow these steps:

1. Go to “Withdraw & transfer” and click on “Withdraw to bank”

2. Choose the account where you want to receive the money. You can select the original bank account you used when signing up for Payoneer, or others you added later.

You can add more accounts (up to 3) in different currencies.

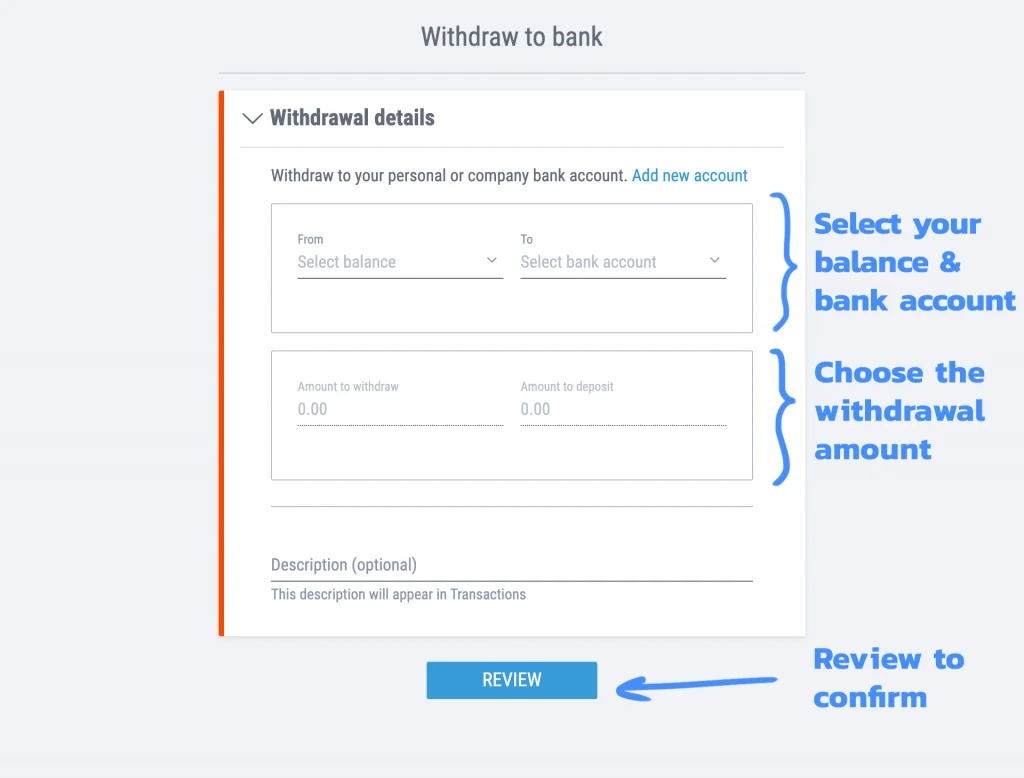

3. Choose the balance you want to withdraw the money from and the bank account to receive it.

4. Enter the amount you want to transfer.

Ideally, the balance and the bank account should be in the same currency.

If not, Payoneer does the conversion. In that same window, you can see how much you are going to receive, the exchange rate, and the platform commission.

5. Click on “Review” to go to the next step.

8. Check that everything is OK and confirm the transfer.

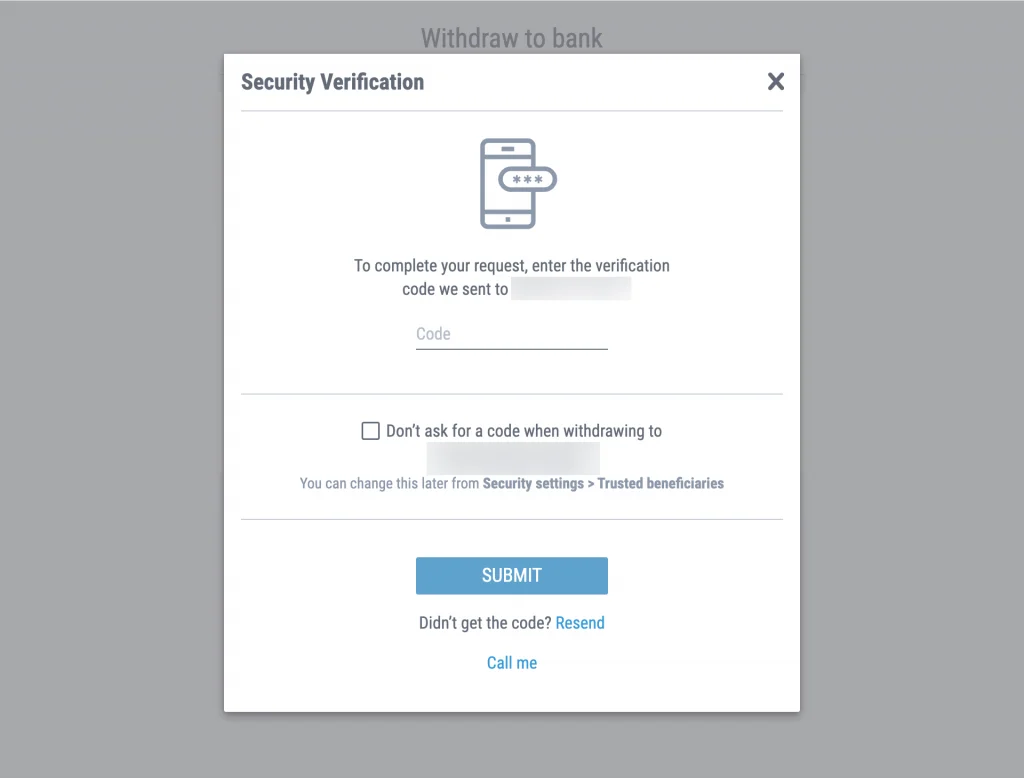

9. You will be asked for a confirmation code sent to your cell phone. Submit it and that’s it!

Remember that transfers are not immediate and that it may take a couple of days before you see the money in your bank balance.

You can also make vendor payments directly to your bank account from Payoneer.

Remember that they always have to be commercial transactions! Payoneer may ask for more details of the receiving account if they think it is from an individual and not a provider.

What are the minimum and maximum amounts to withdraw at Payoneer?

For bank transfers, ATM withdrawals, and transfers between Payoneer accounts, the minimum amount is $50.

The Payoneer card has a US$5,000 daily limit, but you can only make purchases (online or physical) for up to US$2,500.

The maximum withdrawal amounts per ATM vary on the ATM itself. It may be $100 or $2,000.

Unfortunately, there is no way of knowing until the moment of extraction… and you can’t finish the transaction.

You will pay the same commission regardless of how much money you withdraw. It’s always a good idea to get as much money as possible.

Remember that in most cases you can only extract money in the currency of the country you are in.

The exchange rate can be viewed on the Mastercard calculator.

How to buy cryptocurrencies with Payoneer

It is possible to buy cryptocurrencies through Payoneer safely and legally. Without running the risk of having your account closed for going against the platform’s Terms and Conditions.

You will need:

- An account on Binance

- The Payoneer Mastercard

- A cell phone and the number linked to your account to receive the confirmation SMS.

- Payoneer’s 3D security code.

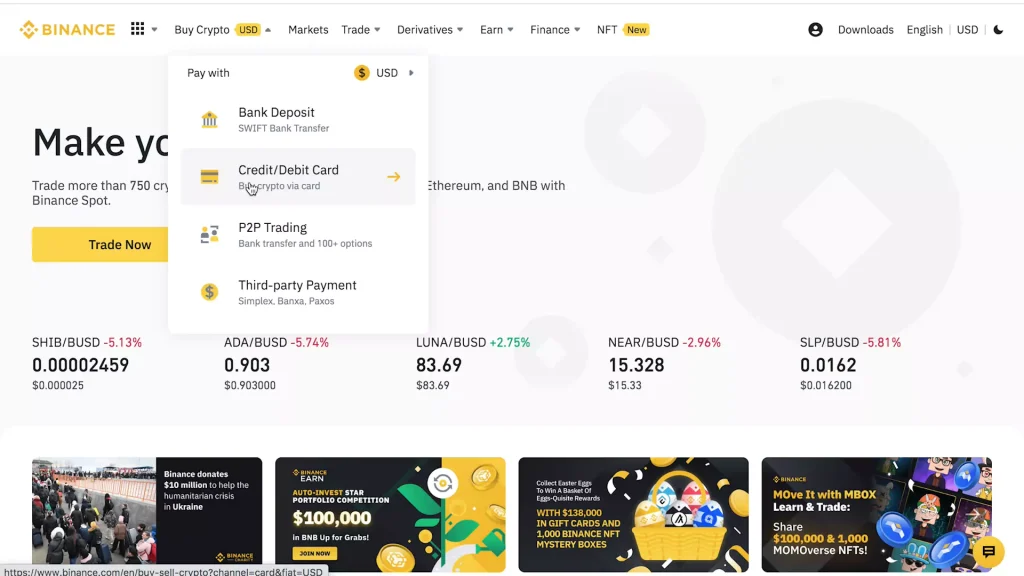

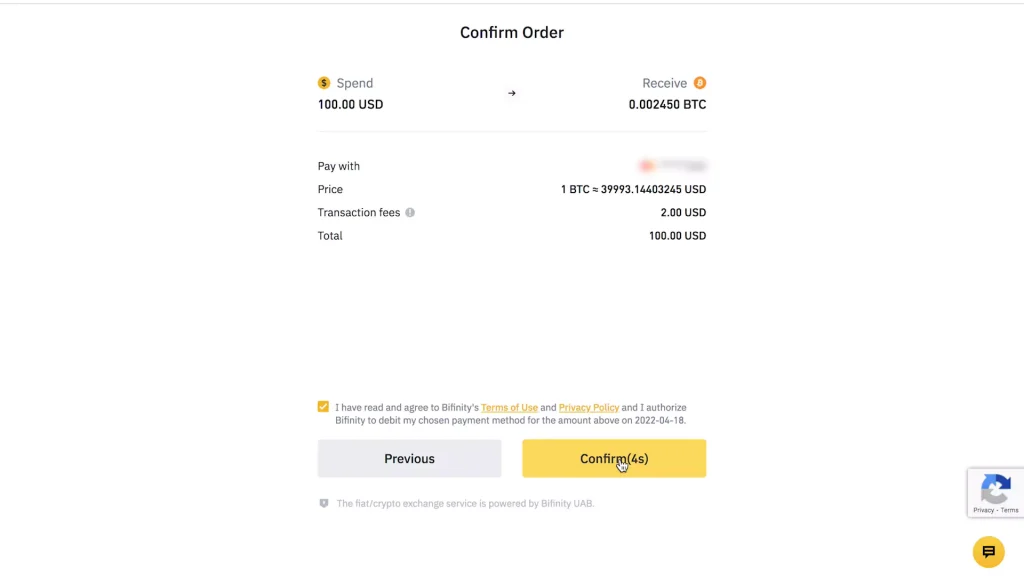

1. Log in to Binance and click on “Buy Crypto”, and select “Credit/Debit Card”

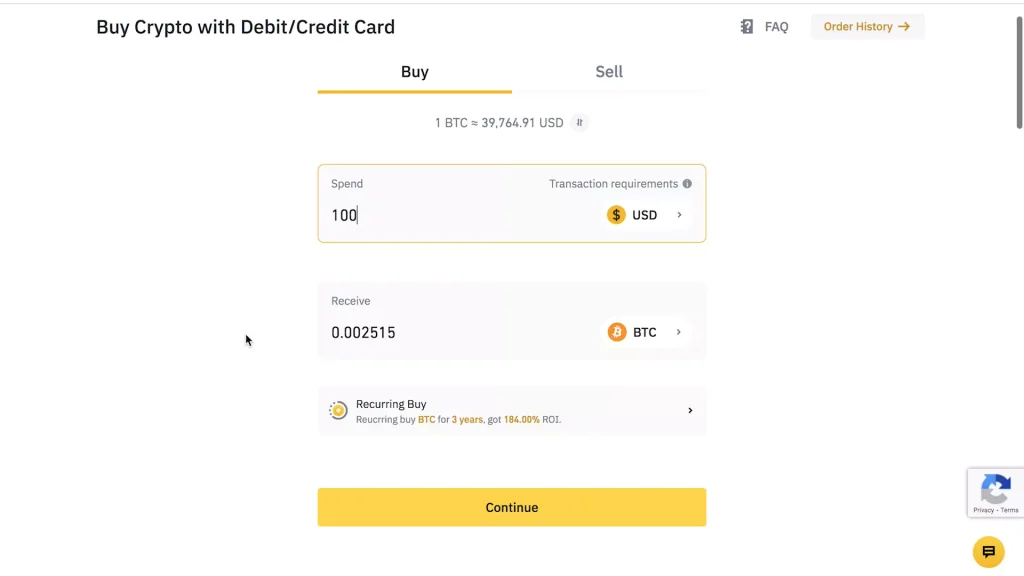

2. Select the currency in which you want to pay. Make sure it matches the one on your card, so there is no surcharge for currency exchange. And of course, select the cryptocurrency you want to buy.

In this same window, you will be able to see the exchange rate at the time of purchase.

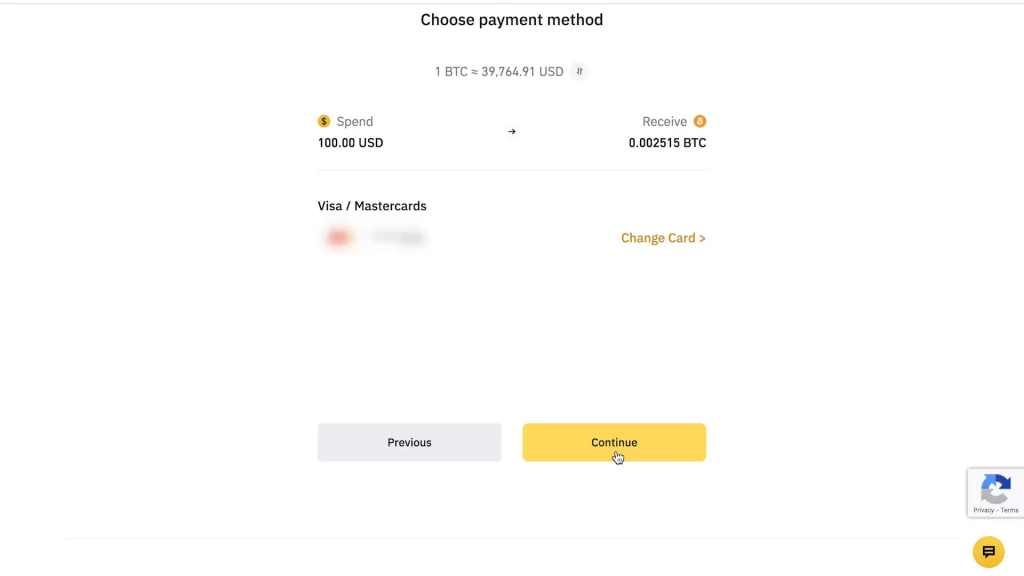

3. Select the payment method. If you do not have any card loaded in the system, you will find a button to do so.

Make sure you fill in the data correctly.

Once you confirm the purchase, you will receive a confirmation SMS on your cell phone.

4. Finally, you need the 3D security code. You might not get asked for it, but is always good to have it on hand.

To find it, log in to your Payoneer account, click on “Security Settings”, and scroll down to the bottom of that page.

And done!

To consider:

Payoneer charges 1% when using the card to buy cryptocurrencies. Binance commissions can be seen at the time of purchase.

This is the safe and legal way to buy cryptocurrencies with Payoneer. Remember that using P2P services is prohibited in the TOS. If you use them, they will close your account.

How much does Payoneer cost?

Although opening an account with Payoneer is free, that does not mean that all services are also free. In this section, find out exactly how much Payoneer costs.

Always learn the operating costs (of any platform) so you don’t find unpleasant surprises when checking your balance.

What are the costs of using Payoneer?

Receive Payments

| From Payoneer to Payoneer | Free! |

| Global Payment Service | Free if payments are in EUR | GBP | JPY | USD | CAD| MXNIf the payment is in USD, the fee is 0%-1% (depending on the country) |

| Request Payment (Direct Client) | 3% if you pay by card regardless of currency. 1% for bank payments in U$D. |

| Mass Payments (Marketplaces) | Depends on the company. You will find this information on the corresponding websites of each Marketplace. |

Wire Transfer

| To your local bank account | Up to 2% above the Market price at the exchange rate of the day. |

| To a bank account in the same currency as your Payoneer balance | U$D1,50 1.50€ £1.50 |

To Payoneer’s bank transfer fees, you must add the bank’s own fees. To find out exactly what they are, you will have to contact your corresponding bank.

Payoneer Card

| Card maintenance | $29.95 / €24.95 / £24.95 per year |

| Card Replacement | USD Card $12.95 EUR Card €9.95 GBP Card £9.95 |

| Purchases in physical or digital stores | Free!* (currency conversion charges apply depending on the case.) |

| Currency Exchange | Up to 3.5% |

| ATM Withdrawal | USD Card $3.15 / transaction EUR Card €2.50 / transaction GBP Card £1.95 / transaction |

| ATM Decline | USD Card $1 / transaction EUR Card €0.80 / transaction GBP Card £0.65 / transaction |

| Balance inquiry at ATM | USD Card $1 / inquiry EUR Card €0.80 / inquiry GBP Card £0.65 / inquiry |

Do not forget, just like bank transfers, ATMs also have their own commissions. If you withdraw through an ATM, you have to calculate the Payoneer commission plus the ATM commission.

If needed, Payoneer uses Mastercard’s exchange rate. You can check out the rates at the official Mastercard calculator.

As always, I recommend that you check the fees on the official Payoneer website, which is always up to date.

Our own experience: when we use the card, we always calculate the 3.5% fee for currency exchange to the total price. Just to be safe.

Now that you know how much Payoneer costs, read on to find out if it’s the right choice for you.

Should you use Payoneer?

Payoneer is one of the payment platforms that we use the most as freelancers and digital nomads. We like the product and feel that it covers most of our needs. But, is it convenient for you?

You should use Payoneer if…

Payoneer is a great option for:

- Freelancers who have clients mostly in the USA, UK, and European countries that use euros.

- Digital nomads and travelers who want to use a card anywhere in the world without worrying about bank fees.

- Actually, anyone who wants to access their money without going through a bank.

- People who need a receiving bank account in different countries.

You should NOT use Payoneer if…

Payoneer is not for you, if:

- You need to make ATM withdrawals most of the time.

- You work only with local clients.

The good thing is that Payoneer is not the only alternative on the market.

Depending on your needs, Paypal, Wise, Verifone, Revolut, or even the traditional bank transfer may suit you.

Keep in mind that besides the commissions and characteristics of each payment platform, there is a requirement that trumps all: make it easy for your clients.

The more difficult it is for the client to put their money in your pocket, the more resistance you will find to get paid.

Warning: Payoneer -or any other payment method- does not exempt you from paying the corresponding taxes according to the legislation of your country.

0 Comments